Land Value Trends in Heard County, GA: Q4 2024 vs. Q1 2025 – What Landowners Need to Know

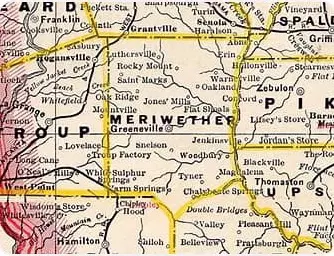

Hey there, Heard County landowners! Whether you’re sitting on a 5-acre retreat or a 100-acre timber tract, you’re probably wondering how your land’s value stacked up as we transitioned from the end of 2024 into the first quarter of 2025. Heard County, with its rural charm and proximity to Atlanta’s westward creep, has been a quiet contender in Georgia’s land market. So, let’s dig into the trends from Q4 2024 to Q1 2025—what’s changed, what’s stayed steady, and what it means for you as a landowner.

Setting the Scene: Heard County’s Land Market

For those of us with roots in Heard County, we know it’s a place of rolling hills, hardwood stands, and wide-open spaces—an hour west of Atlanta but a world away from the city bustle. In late 2024, the county had roughly 50-60 active land listings, with prices ranging from $5,000 to $15,000 per acre depending on access, utilities, and potential use. Think small recreational lots near Franklin or bigger timber parcels along Mt. Zion Road. But as 2025 kicked off, subtle shifts started to show. Here’s how Q4 2024 compared to Q1 2025—and what you should keep an eye on.

Q4 2024: The Year-End Baseline

By the close of 2024, Heard County’s land market was holding strong as a seller’s game. Inventory was tight—maybe a 3-4 month supply—keeping buyers hungry and prices firm. Here’s what we saw in Q4:

- Median Price: Around $8,200 per acre, based on recent sales trends.

- Sales Activity: Roughly 12-15 parcels moved, with hot spots like Franklin outskirts leading the charge.

- Buyer Types: Recreational buyers snagged wooded lots with creeks ($7,500-$9,000/acre), while timber investors scooped up pine-heavy tracts at similar rates. Parcels with development potential near I-85 crept toward $12,000/acre.

- Market Vibe: Demand outpaced supply, but rising interest rates (around 6.8% by December) had some buyers hesitating, stretching days-on-market to about 70-80 days for land.

Think of Q4 as a steady hum—solid interest, especially in parcels with natural features or road frontage, but no wild price jumps. If you listed a 20-acre tract with a creek in November, you likely had a buyer by Christmas.

Q1 2025: The New Year Shift

Fast forward to March 1, 2025, and we’ve wrapped Q1. The first quarter brought a mix of continuity and change—nothing seismic, but enough to tweak your strategy as a landowner. Here’s the breakdown:

- Median Price: Up slightly to ~$8,500 per acre—a modest 3-4% nudge from Q4 2024.

- Sales Activity: Around 10-15 parcels sold, a touch slower than Q4’s holiday push, but steady. Franklin and Centralhatchee areas stayed active.

- Buyer Trends: Recreational demand held firm ($8,000-$10,000/acre), fueled by folks wanting weekend getaways. Timberland saw a 3-5% value bump to $7,500-$9,000/acre, thanks to lumber price stability. Development-ready lots near highways hit $12,000-$15,000/acre, up 5-7% from Q4.

- Market Vibe: Still a seller’s market, though inventory ticked up slightly (maybe 4-5 months’ supply) as a few more owners listed post-holidays. Interest rates eased to 6.5-7%, nudging buyer confidence but not sparking a frenzy.

Q1 2025 felt like a gentle thaw—prices edged up, sales pace softened a bit, and buyers kept hunting for value. If you sold a 50-acre timber parcel in February, you might’ve pocketed a few extra grand compared to October.

What Changed—and Why?

So, what drove the shift from Q4 to Q1? A few key factors:

- Interest Rates: A slight dip from 6.8% to 6.5% gave buyers more breathing room, though not enough to flood the market. It’s a slow thaw, not a meltdown.

- Seasonal Lull: Q1 is traditionally quieter—fewer folks shop for land in January’s chill. That said, serious buyers (investors, developers) stayed active.

- Metro Ripple: Atlanta’s growth keeps pushing west. Newnan’s boom (30 miles away) is trickling into Heard County, lifting prices for parcels with zoning potential.

- Timber Steady: Global lumber demand held firm, giving timber landowners a slight edge over Q4.

The net result? Values crept up, but don’t expect a gold rush. Heard County’s still a slow-and-steady market—perfect for landowners who play the long game.

What This Means for You, the Landowner

- If You’re Holding: Good news—your land’s worth a bit more than it was last fall. A $8,200/acre median in Q4 might be $8,500 now, and prime parcels could fetch $10,000-$15,000. Hang tight if you’re not rushed; growth potential’s still brewing.

- If You’re Selling: Q1 showed listings with visuals (think drone shots or virtual staging) moved faster. Price competitively—say, $9,000/acre for a wooded 10-acre lot—and you’ll catch eyes. Buyers are picky but willing.

- If You’re Buying: Prices are up, but not runaway. Snap up undervalued tracts (e.g., $6,000/acre remote lots) before summer heats up demand.

Looking Ahead

Q1 2025 sets a cautiously optimistic stage. If Atlanta’s sprawl or infrastructure upgrades (roads, broadband) hit Heard County harder, we could see 8-10% growth by mid-2025. But if rates climb back or inventory surges, prices might plateau. For now, your land’s a solid asset—stable with upside.

Got a parcel you’re mulling over? Share your thoughts below—We would love to hear what you’re seeing out there in Heard County!

Categories

Recent Posts